Three chapters

The deputy CEO of Lloyd’s Europe divided his presentation in three chapters. The first part focuses on the future and how we can prepare for it, emphasising the role of insurance as a solution for managing uncertainties. It highlights the importance of creating plausible scenarios to anticipate and manage future risks.

The second part addresses the issue of protection gaps, where available insurance solutions are not being utilized. It explores the reasons behind these gaps and compares Europe’s situation with that of the US to understand the implications for Europe.

The final part is solution-oriented, aiming to brainstorm potential solutions. It focuses on initiatives by Lloyds Europe to make the European environment more attractive and better prepared for future challenges.

Understanding the world around us

The global environment today presents significant challenges, marked by volatility, uncertainty, complexity, and ambiguity. These factors create a dynamic landscape that risk managers must navigate, as they threaten the stability and prosperity established by previous generations and could significantly affect the quality of life for future ones. In light of these challenges, Lloyds has partnered with Cambridge University’s Center for Risk Studies to develop scenarios that help anticipate and manage potential future risks. This collaboration involves analysing and interpreting large sets of sometimes unstructured data to make informed predictions about possible outcomes.

- Benoît Waltregny explores specific scenarios to assess their potential impacts on the economy and society. A key focus is on natural catastrophes, with scenarios that simulate the effects of extreme weather events on economies and supply chains. These scenarios use historical data to predict potential losses over a five-year period, considering factors such as GDP impact, supply chain disruptions, and industry effects. By analysing events like those recently seen in Spain, the Czech Republic, and Poland, along with wildfires in Portugal, Lloyds assesses the frequency and intensity of such occurrences and their economic implications.

- Another critical scenario examines the threat of major cyberattacks. These scenarios consider the simultaneous and persistent nature of cyber threats, which can disrupt global systems and erode confidence in digital transactions. The analysis explores the potential impact on payment systems, financial institutions, and supply chains, assessing both immediate damages and long-term consequences. The scenarios examine attacks targeting data confidentiality, integrity, and availability, highlighting the need for alternative solutions and the time required to implement them. The big challenge is the modelling of cyber risks, which are less predictable than weather events due to limited historical data. Academics use proxy adjustments to estimate these risks, considering dependencies on the Internet of Things and AI developments.

- Geopolitical conflict is also explored, focusing on potential tensions between China and Taiwan. On a global scale, sanctions and compromised shipping lanes could cause widespread disruption to global trade networks and supply chains. The impact on infrastructure could be immediate. Europe could be significantly affected due to its dependencies, highlighting the need for competitiveness and independence.

Conclusion: Benoît Waltregny stresses that insurance solutions exist for each scenario. ‘For weather events, parametric solutions and disaster risk facilities are available to provide automatic financing when triggers are met. In cyber risk, Lloyds holds a significant market share, offering prevention mechanisms and risk-friendly solutions. For geopolitical risks, insurance options include credit insurance, political risk insurance, and contingent business impact insurance. These cover losses from government actions, payment disruptions, and reduced turnover. A recent example is the creation of an insurance scheme for grain shipments from Ukraine through the Black Sea, organized with the UN and NGOs. This facilitated the delivery of essential goods to vulnerable economies, supporting both Ukraine’s GDP and global food security.’ In conclusion, while challenges exist, insurance provides valuable tools for managing these complex risks.

Analysing the protection gaps

For the deputy CEO Lloyd’s Europe Waltregny it is important to know what he means by protection gap. ‘There are different kinds of protection gaps, and I’m zooming in on the non-life complex risk protection gaps. There are also gaps about health, pensions, etc. but I’m not covering those. We are focusing on what we know at Lloyds, which is very specialized risk and the coverage that could be provided for those.’

He continues by saying that there is a difference between the risk protection gap and the insured protection gap. The risk protection gap is the difference between the economic loss and the insured loss. ‘That’s not what I’m looking for because in fact not everything can be insured, and probably it’s not even adequate to insure everything. So there is a decision that needs to be made at some point and questions needs to be asked: what do we prevent? What do we want to bear as risk? What do we want to transfer?’

Waltregny is basically looking at the insurance protection gap, which is more or less the difference between the risk protection gaps and the insurance. ‘So in other terms, what could have been insured but has not been insured. The responsibility for risk managers to take at some point in time a decision: do we want to transfer the risk?’ and in fact there has been none.

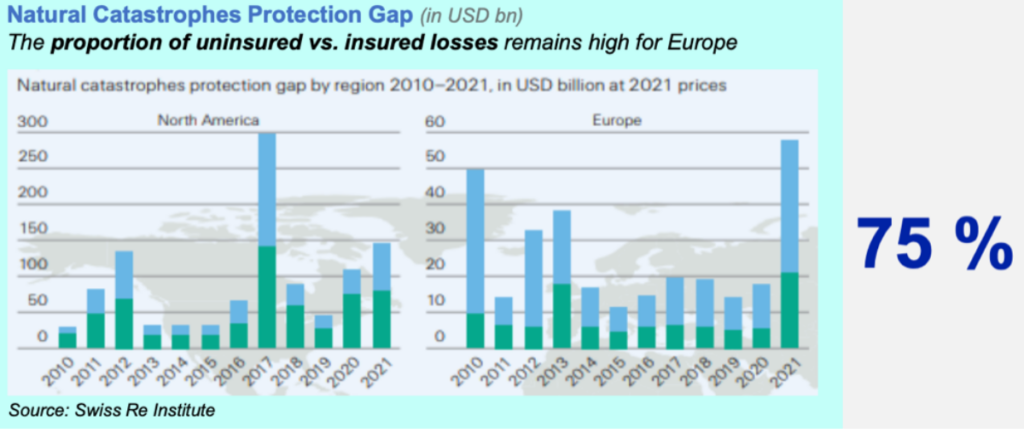

- For Nat Cat, only 25% is covered while 75% could have been insured. In terms of cyber, it’s even worse. So only 10% is covered, while there is a possibility to insure more. When he compares the US and Europe, he observes that the protection gap is two times less important than the European one. ‘So just by catching up and trying to be similar to the US, we could already double the size of the premium that are written.’ Basically, there is not enough capital that is allocated to insurance and invested in terms of covering the risk that needs to be covered.

- He also points out the complex dynamics of capital allocation within the insurance market, particularly the trend of capital moving from Europe to the United States. ‘There are several critical factors that influence the decision-making process surrounding where capital is invested. Profitability is paramount, as investors seek sustainable returns when underwriting risks. This profitability is closely linked to the understanding of the local environment, including the regulatory landscape and the relationship between industry players and local authorities.’ He gives an example where negative experiences related to judicial decisions led to reduced interest from insurers. ‘These instances demonstrate how regulatory and legal environments can significantly impact market attractiveness. If Europe fails to present itself as an appealing option for capital allocation, it risks being left behind in the global market.’

- Waltregny notes that while there are protection gaps that exist globally, it is critical to understand whether the challenges stem from supply constraints or a lack of demand. ‘On the supply side, issues such as inadequate data and regulatory friction are identified as barriers to providing sufficient insurance solutions. For example, in the cyber insurance sector, initial pricing and risk assessments were hampered by a lack of data, resulting in difficulties in finding adequate coverage. Conversely, on the demand side, there seems to be a prevailing lack of awareness regarding potential risks, such as those posed by climate change, cyber threats, and geopolitical instability. This lack of awareness can lead to hesitance in purchasing insurance products, which in turn affects market dynamics.’ He also highlights the phenomenon of moral hazard, where individuals may rely on government intervention during crises, assuming that they will not have to bear the full cost of risk management themselves. This mindset can diminish the perceived need for insurance.

- Furthermore, he emphasizes the absence of a well-defined insurance market in Europe, which contrasts with the more established surplus market in the US. He argues that while Europe does have numerous insurance companies, the lack of a centralized marketplace limits competition and makes it challenging for consumers to access the best options available. ‘A true insurance market would provide a structured environment where demand meets supply effectively, allowing consumers to find tailored solutions without navigating a fragmented landscape.’ He also touches on the importance of data in driving market efficiency. Waltrengny suggest that increased access to comparative data could enhance competition and lead to better pricing and availability of insurance products. The idea is not merely to create a single market, but to establish specialized markets that cater to unique needs, similar to models seen in other jurisdictions.

Finding potential solutions

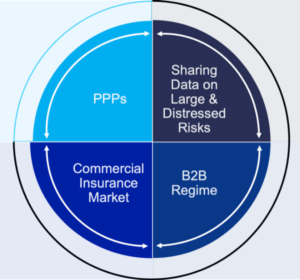

At Lloyd’s Europa, four types of solutions are taken into account. ‘Our perspective, shaped by our extensive experience in managing risk, allows us to identify and propose several key practices that could enhance our industry.’

Importance of Data Sharing

The speaker places a significant on the necessity of sharing aggregated data, especially concerning large and distressed lists of risks. He argues that the insurance industry faces a critical issue with data scarcity, which hinders the ability to assess new and evolving risks effectively. ‘While there is a wealth of existing data, many organizations are reluctant to share this information due to concerns about confidentiality and regulatory compliance. We advocate for a shift in perspective, suggesting that data should be viewed as a communal resource rather than proprietary information.’

He highlights examples of successful data-sharing initiatives, such as those in the United States, where mandatory data aggregation occurs through independent bodies. ‘This practice has reportedly led to improvements in cyber risk policies. The London market is also cited as a model for data sharing, where participants collaborate to enhance their understanding of risks.’ The speaker emphasizes that fostering a culture of open data sharing, while maintaining confidentiality, could significantly benefit the industry. It would provide a clearer picture of the risk landscape, facilitate better pricing models, and encourage capital providers to view protection gaps as new market opportunities, thereby potentially attracting investment from outside the traditional insurance realm.

Revising the B2B Regulatory Framework

Waltregny also discusses the regulatory environment, particularly the Insurance Distribution Directive, which currently lacks adequate differentiation between the needs of various clients. He notes that other sectors, such as investment banking and consumer lending, have more nuanced regulations that recognize the sophistication of clients and tailor protections accordingly. ‘In contrast, the insurance sector often treats all clients uniformly, which can lead to inefficiencies and increased costs.’

He points out that the new commission has announced a revision of the Insurance Distribution Directive, presenting an opportunity to address these issues. ‘By distinguishing between clients with complex risks who require specialized services and those who purchase standard insurance products, the industry can reduce unnecessary regulatory friction. Such differentiation could streamline processes and enable better alignment of supply and demand, ultimately leading to a more efficient market.’

Commercial insurance market

In managing risks within the insurance and reinsurance sectors, he emphasizes the need for collaboration between public and private entities to address complex and systemic risks. He starts by underscoring that effective interaction between these sectors is crucial for expanding the overall capacity to manage risks, particularly in a global context.

A key point made is the essential function of reinsurers, which are pivotal in maintaining stability within the insurance market. ‘Without reinsurance, the insurance market cannot operate effectively—reinsurers allow insurance companies to determine which risks they can afford to keep, cover, or transfer. This dynamic is vital for risk diversification and mutualization, as it enables insurers to manage their portfolios with greater confidence.’ He highlights that the reinsurance market is global in nature, which means that risks, such as cyber threats that can affect multiple regions simultaneously, require a coordinated international response.

The speaker also touches on the intervention of governments and supranational organizations, such as the European Union, particularly when the private sector is unable to cover certain risks. He illustrates this with the example of Italy, where the government incurs approximately €10 billion annually to cover risks that private insurers do not address. ‘This reliance on government support raises concerns about financial stability, prompting calls for more sustainable solutions.’

He advocates for the establishment of predictability in insurance agreements, which would encourage additional capacity in the market and ultimately reduce the financial burden on public authorities. ‘By clarifying who is responsible for covering various types of risks—whether they are high-frequency, short-tail events or low-frequency, long-tail events—stakeholders can create a more structured approach to risk management. This predictability is attractive to potential investors and can lead to increased participation from the private sector.’

The role of public-private partnerships (PPP):

Another significant aspect that he discusses, is the concept of supranational PPPs. Waltregny notes a shift in perspective over the past five years, moving from scepticism about the effectiveness of PPPs to recognizing that national efforts might be insufficient to tackle the challenges faced at the European level. ‘This acknowledgment points to the need for a more integrated approach that leverages solidarity among EU member states to address risks that transcend national borders.’

The speaker further emphasizes the importance of attracting global capital to support the insurance industry. He highlights ongoing discussions within the European authorities regarding the capital market union, which aims to activate the capital of European citizens and attract investment from abroad. He suggests that there is a need to create an environment that is welcoming to foreign capital, which can provide necessary funds when crises occur.

Moreover, the speaker discusses the potential for new entrants to the market, such as pension funds and health insurance funds, to contribute capital to the insurance sector. ‘These entities may not have extensive knowledge of the insurance industry but can provide vital financial resources. The success of prominent investors, like Warren Buffett, is an example of the potential attractiveness of insurance as an asset class for various investors.’

Key takeaways

Benoît Waltregny emphasizes the need for a new approach to navigating the complexities of today’s volatile and uncertain world. While acknowledging that some traditional methods have been effective in the past, he argues that they are no longer sufficient on their own. He advocates for the use of scenario analysis as a powerful tool for understanding potential risks and outcomes, suggesting that organisations should develop their own scenarios based on accessible data.

The speaker asserts that insurance plays a crucial role in addressing these challenges and highlight the current inadequacy of coverage, which exists on both the supply and demand sides. He stresses the importance of encouraging policymakers and authorities to learn from successful practices in other regions, rather than solely focusing on the shortcomings in Europe.

‘Collaboration among all stakeholders—governments, insurers, risk managers, and brokers—is deemed essential for effectively tackling the significant challenges ahead.’ He believes that proven solutions exist and can be implemented if there is a collective effort to make them happen, fostering a more resilient and responsive insurance landscape.

Lloyd’s Europe

The deputy CEO of Lloyd’s Europe also talks about his own company: it’s a household name, but that doesn’t mean everyone knows exactly what the group does.

- Lloyd’s Europe functions as a fully-fledged insurance entity, adhering to all regulatory frameworks such as the Solvency II and IDD requirements. It is regulated by the National Bank of Belgium (NBB) and the Supervisory Market Authority (SMA), underscoring its compliance and robust regulatory oversight. It stands as the largest Property and Casualty (PNC) insurer in Belgium, maintaining active dialogue with European regulators, including a presence in the European Insurance and Occupational Pensions Authority (EIOPA).

- Lloyd’s Europe operates across 32 countries, encompassing the European Economic Area, Monaco, and the UK. It holds 14 licences for freedom of establishment and 29 for freedom of services, allowing it to service a wide range of locations. This extensive reach is supported by a network of about 170 registered brokers and numerous cover holders and service companies. These cover holders, akin to brokers, work under mandates to represent Lloyds rather than individual clients. The company employs around 300 accredited underwriters for ITD business, although more underwriters are involved in less regulated, non-ITD business areas. The company places particular emphasis on sectors such as aviation, transport, general liability, and pecuniary losses.

- ‘The group operates as a unique marketplace for insurance and reinsurance, distinct from traditional insurance companies. It facilitates the interaction between supply and demand, bringing together major European players such as AXA, Munich Re, and Aviva.’ He adds that this marketplace model is supported by a robust chain of security, which not only ensures high credit ratings for its members but also guarantees the payment of claims. ‘The central fund, a mutual pot contributed by all members, serves as a financial safety net, ensuring that risks are adequately covered, and claims are paid, thus maintaining the solvency and profitability of its participants.’ The role of corporation is also about making sure that things are going right, he said. ‘And therefore, there is also an interest for the corporation to ensure that those who are active have the right information and take the right decisions. And therefore, a lot of attention goes to innovation about data sharing and helping the members to understand exactly what can be done.’

- Lloyd’s was created about 330 years ago and was always a frontrunner. ‘It has been the first to create a car policy in 1904, an airplane policy in 1911, and that’s quite close to when cars have been built or planes started to fly. The fact that it had the first cyber risk policy in 1999, demonstrate its long-standing commitment to pioneering solutions for emerging risks. This tradition of innovation continues today, with policies for drones, driverless cars, and the circular economy, reflecting Lloyds’ proactive approach to evolving challenges.’